Calculate Your FICO Credit Score

FICO Scores

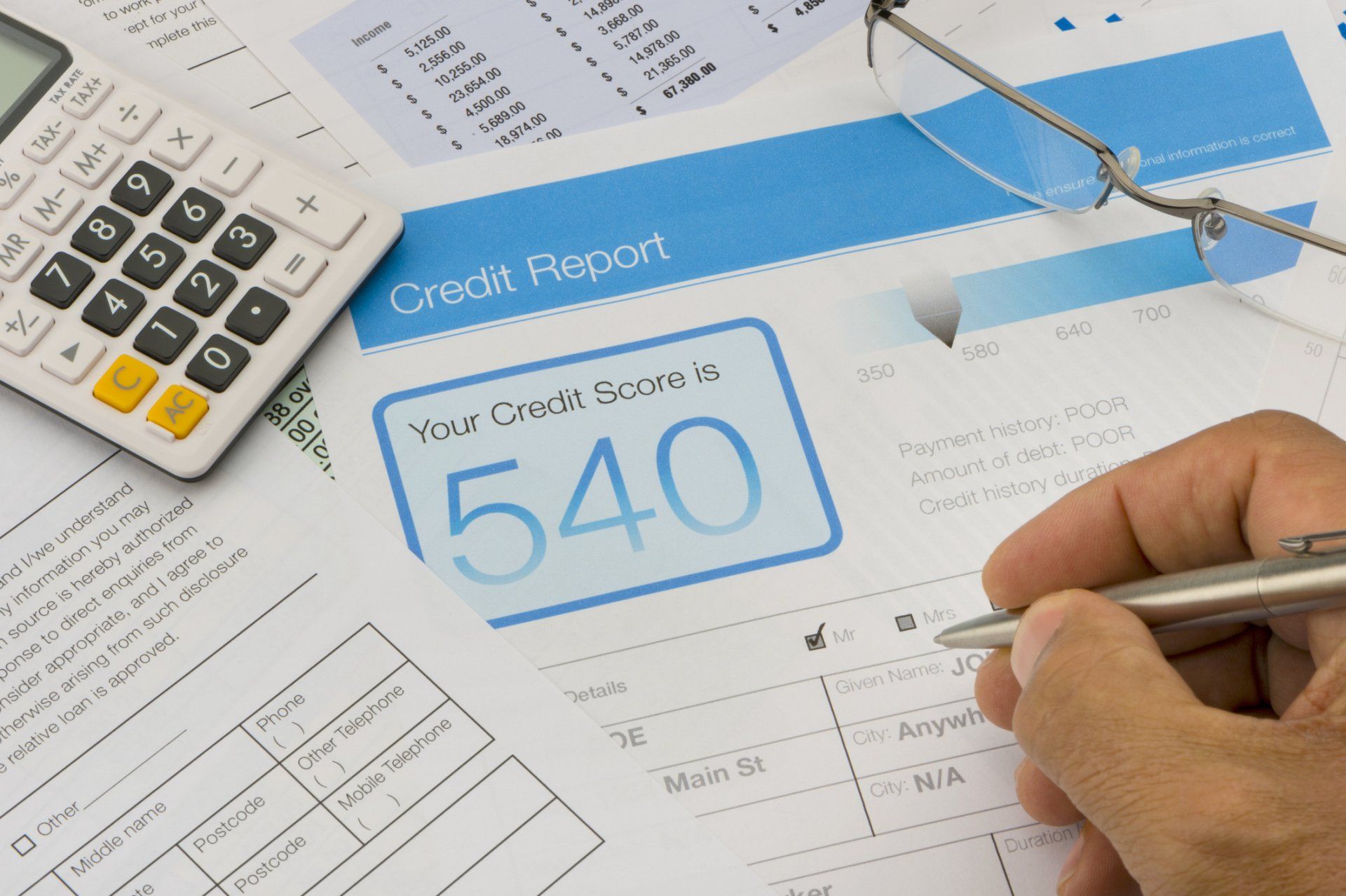

Credit bureau scores are often called “FICO scores” because most credit bureau scores used in the US are produced from software developed by Fair, Isaac and Company. FICO scores are provided to lenders by the three major credit reporting agencies: Equifax, Experian and TransUnion. The credit score is a number, based on an analysis of information contained in a credit report, which provides an indication of how likely a person is to repay his or her debts. The number itself can range from 300 to 900.

FICO scores provide the best guide to future risk based solely on credit report data. The higher the score, the lower the risk. To learn more about your credit score, reach out to Credit Rescue Inc. in Albuquerque, NM. Dial

(505) 899-1448.

● 35% of the score is based on your payment history. The score is affected by how many bills have been paid late, how many were sent out for collection, bankruptcies, etc. When these things happen, it can also affect your score. The more recent, the worse it will be for your score.

● 30% of the score is based on outstanding debt. How much you owe on car loans, home loans, etc. How many credit cards do you have and how many of them are at their credit limit. The more cards you have at their limits, the lower your score will be.

● 15% of the score is based on the length of time you’ve had credit. The longer you have established credit, the better it is for your score.

● 10% of the score is based on the number of inquiries on your report. If you’ve applied for a lot of loans or credit cards, you will have a lot of inquiries on your report. These are bad for your score because these indicate that you may be in some kind of financial trouble. The more recent the inquiry, the worse it is for your score.

● 10% of the score is based on the types of credit you have. The number of loans and available credit from credit cards makes a difference.

In need of an experienced credit agent? Book our services by calling (505) 899-1448.