Redeeming and Correcting Bad Credit

Credit Anatomy

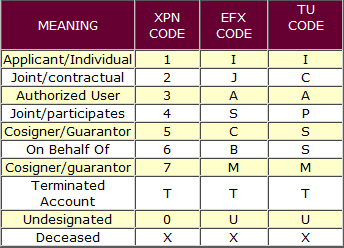

WHOSE ACCOUNT:

Indicates who is responsible for the account and the type of participation you have.

XPN= EXPERIAN / EFX= EQUIFAX / TU= TRANSUNION

On the right or left side of your credit report you will find a column that is marked status. You will find either R1-R9 or I1-I9 or O1, let's talk about what R/I/O means.

R= Revolving:

This means no matter how far in advance you pay this type of account there is a payment due every month as long as the account carries a balance.

I= Installment:

This type of account can be paid (For Example) 6-months in advance and you will not have a payment due for 6-months.

O= Open:

This means balance in full is due every month

Contact us today in Albuquerque, NM, and let us show you how to take care of your own credit for the rest of your life! For a free consultation, dial

(505) 899-1448.

IDENTIFYING NEGATIVE CREDIT

R2-R5 and I2-I5 means the account is delinquent, although an R1 or I1 = Current account could have been delinquent at one time and now is current, remember 35% of your credit score is based on your ability to pay on time.

R7= Means making regular payments through a third party, for example: credit counseling service, or a wage earner plan paid through a Chapter 13 bankruptcy or in some cases arraignments directly with the creditor themselves. REMEMBER: If you have filed and completed a bankruptcy (Chapter 7) there should be a 0 in the balance fields on everything you included in your Chapter 7 bankruptcy. If there is a balance in these fields you must have them removed. Remember: Fico Score’s go by debt to income ratio and the debt to income ratio comes from the balance fields.

R8= Repossession: this means the bank has taken back the security of the debt such as Auto or Home, whatever the debt was secured by. This is where you have to be careful, in a lot of cases the lender will sell the repossessed item for a lot less than its worth and come after the remainder of the loan, this is also known as the deficiency balance, so if your lender tells you just turn in the car and all is forgiven, get it in writing. Note: If you are upside down on your car (owing more than the car is worth) you need to talk to your insurance agent about getting (Gap Insurance) this is in case your car is totaled, the insurance company is only going to give you market value, and without Gap Insurance you would owe the rest of the debt and have nothing to show for it. Gap Insurance if you had it would pay the balance of what was left after the insurance paid the market value.

R9= Profit and Loss also known as P & L. This takes place when a creditor has written your account off as a bad debt, unable to recover funds in the time allowed by the bank, these accounts can be sent to OSA = Outside Agency (collection agency) or could be referred to legal or in some cases some banks have their own inside collection agency.

P.S. Be careful, there are attorneys out there that will talk a consumer into filing a Chapter 13 knowing the consumer cannot afford to make the payments. So later on down the road, the consumer will have to file a Chapter 7 Liquidation, allowing the attorney to collect two separate fees. Remember the bankruptcy attorney's income relies on the amount of bankruptcies they file. Think about it – It is their BUSINESS – do not fall into this trap!